TSB-M-11(8)M:(7/11):Implementation of the Marriage Equality Act Related to the New York State Estate Tax:tsbm118m

Ten Important Points to Remember About International Estate Planning for Persons with Connections to the United States

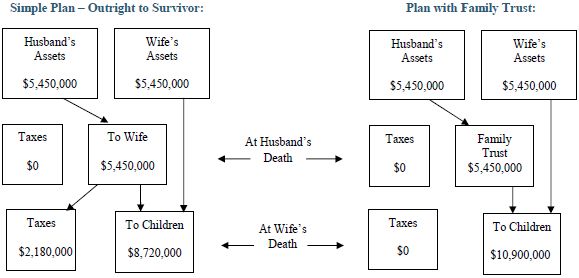

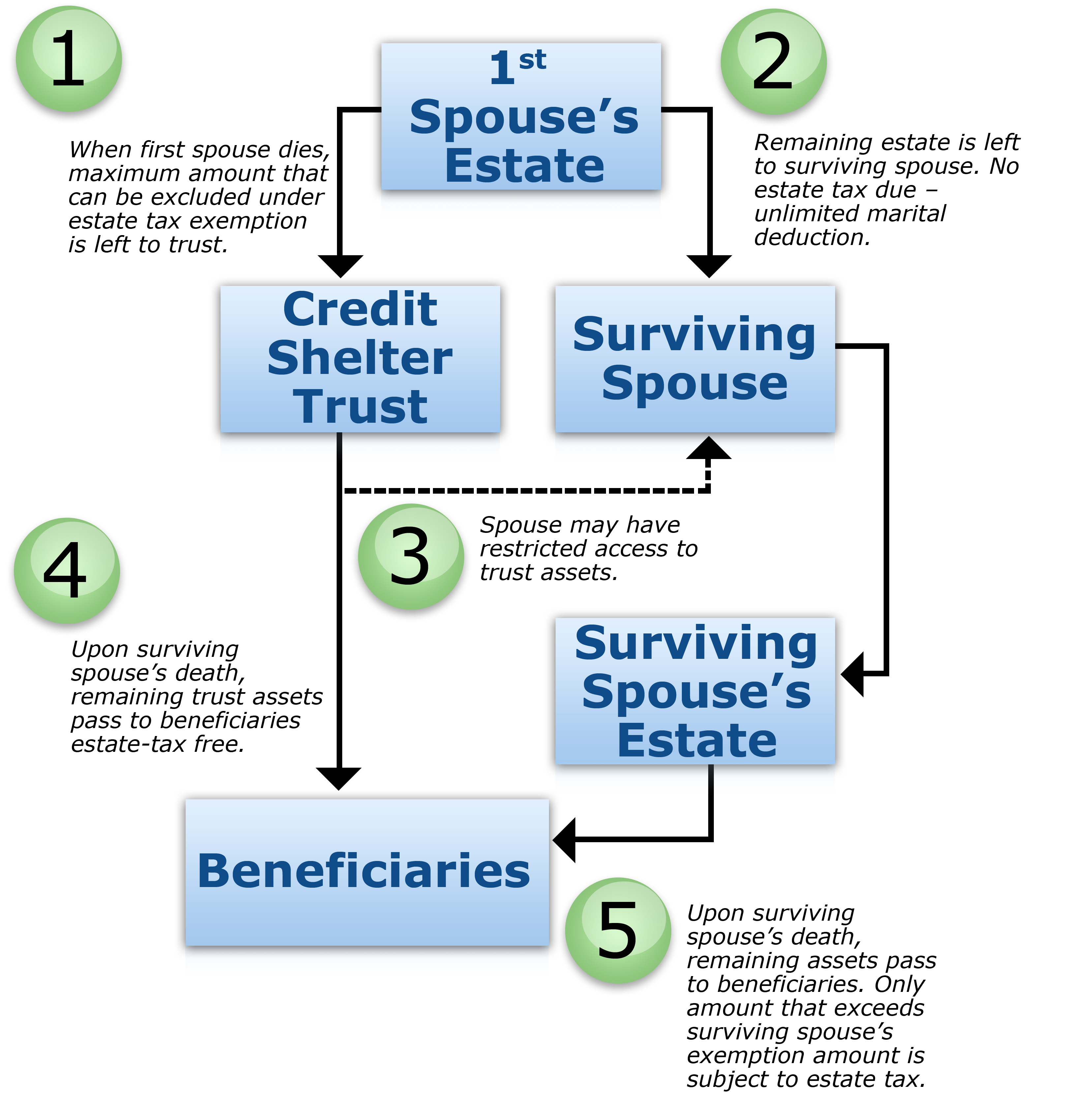

Free Report: What is the Estate Tax Marital Deduction? - Litherland, Kennedy & Associates, APC, Attorneys at Law

/Telecom/Telecom%2017.png?width=1280&height=853&name=Telecom%2017.png)